| | | | |

| DAILY BRIEFING | | Today's news & insights for the beverage industry. |

|

|  | 📰 Today's Top Story | | | The NPG never sleeps. You would think that, while the BevNET edit team was deep in the bowels of the Philadelphia Convention Center covering the final Expo East, the beverage gods might give us a break, but no such luck. This week’s return of our weekly new product gallery is a bumper edition clocking in at over 15 slides spanning from Halloween CSDs to OLIPOP’s new flavor to cannabis drinks and a Bloody Mary mix from a well-known condiment brand. Here’s a few of the highlights, and why. Electrolit + BodyArmor: Power in Powders When did powder sticks become a status symbol for sports hydration brands? These two may be a bit late to the party, but regardless they still represent a pair of top-5 category players entering the fray, providing further confirmation of the format as a convenience-oriented, ecomm-friendly route to expansion. It’s notable that both products are built around “rapid hydration” formulas akin to what health organizations recommend for treating dehydration, a positioning that has fueled powder-exclusive brands like Liquid I.V. and nuun, both of which have been acquired by strategics. We’ll have a closer look at Electrolit’s powders next week at the NACS convenience store trade show in Atlanta; while that brand keeps chugging along, BodyArmor will be hoping Flash I.V. powders can re-energize the flagging sports drink label amidst concerns that chief rival Gatorade is extending its category lead. After all, its own rapid hydration drink, Gatorlyte, came out in 2021. Alani Nu Mini Cans After years of being defined by category leaders Red Bull and Monster, energy drinks have evolved into a diverse and dynamic space teeming with new functional ingredients and more prescribed use occasions. That thinking has begun to extend to the package itself: see Alani Nu now offering its female-skewing energy drinks in 8 oz. cans. Yes, that’s roughly the same format as a standard Red Bull, but for a brand like Alani that retains a strong D2C consumer base alongside a growing presence in big box and club stores for its 12 oz. slim cans, a smaller can may encourage trial and extend usage into more (or other) day parts. With momentum behind it (+62.6% sales and +55.7% volume, per our latest Nielsen report), this feels like the right time to strike. NOCCO How are your amino acid levels? Not a question that we get a lot, but maybe we should: branch chain amino acids (BCAAs) are a small and differentiated sub-segment of the quickly growing, supplement-inspired “performance energy” space, and one that relatively few brands have focused on exclusively. But Nocco, a division of Swedish nutrition group Vitamin Well, continues to make strides with tropical and fruit-themed flavors, the latest being Juicy Razz. Now that pace of innovation seems to be picking up – highlighted by Optimum Nutrition’s AMIN.O Energy line and recent UK import Exponent Fusion Energy – suggesting that consumer awareness and education is tracking in the right direction. Others like FitAID, Kill Cliff and PWR LIFT are helping that cause by integrating BCAAs as value-adds into their products, but it remains to be seen how strong of a purchase driver the ingredient can truly be. Check Out the Full Gallery On BevNET |

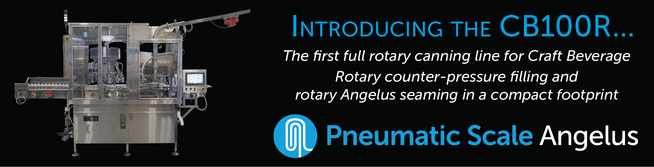

| | | | Sponsored message from Pneumatic Scale Angelus | Say hello to our latest craft beverage canning line: the CB100R continuous motion rotary counter-pressure machine pairs 12-head rotary filling with a 3-spindle rotary seamer for filling speeds of more than 100 CPM. Experience precision filling and the lowest dissolved oxygen levels in the industry!

Learn more

|

| 👉🏼 What You Need to Know 👈🏼 | | | - Building on its partnership with Target (now with 1,000 new doors added), bagless tea company Tea Drops is expanding into hundreds of stores with new partnerships in Walmart and Sprouts Farmers Market stores. The brand is launching eight products in Sprouts nationwide including an exclusive strawberry matcha honey boba kit. In Walmart, Tea Drops is debuting an exclusive vanilla bean latte kit and strawberry matcha latte kit, alongside its ube and chai spice latte kits in about 1,500 locations.

- Seattle-based Jones Soda has expanded its cannabis drink line Mary Jones from California into Washington State dispensaries. Available in 12 oz. and 16 oz. cans, the sodas are infused with 10mg or (a whopping) 100mg of THC, respectively, in four flavors: Root Beer, Berry Lemonade, Green Apple, and Orange & Cream. The launch is expected to be followed by expansion into Nevada and Michigan.

- Nootropic soda brand Perfy announced it would now be available in 15 Utah-based Harmons Grocery locations. The launch includes all four of the brand’s zero-sugar, superfood varieties (Blood Orange Yuzu, Tropical Citrus, Fruit Punch and Dr. Perfy).

- Adaptogenic RTD coffee maker Taika is now available in 265 Whole Foods Market stores across 16 states. The partnership is focused on the Northeast region as well as California, Nevada and Arizona.

|

| | | Private equity firm Wind Point Partners is looking to sell off aseptic products manufacturer Gehl Foods, valuing the company at $600 million including debt, according to a Reuters report this week. - Founded in 1896, Wisconsin-based Gehl does business as Gehl Food & Beverage and offers manufacturing for a variety of products including dairy and non-dairy beverages like milk, plant-based dairy alternatives, tea and coffee, alongside sauces, puddings, wine and spirits. The company has plants in Wisconsin, Californian and South Carolina.

- Wind Point acquired Gehl in 2015. Gehl has hired William Blair and Bank of Montreal as financial advisers and it is now seeking out potential buyers, including other private equity firms, but there’s also a chance that no deal will happen.

- According to Reuters, the company could “fetch a valuation equivalent to 10 times the company’s 12-month earnings” of about $60 million.

- The report arrives as another major U.S. co-packer has been sold to private equity. This week, Manna Beverages & Ventures – a group associated with Manna Capital Partners – announced it has reached an agreement to acquire legacy California co-packer Nor-Cal Beverage Company.

|

| | | | Functional beverage brand Cloud Water first made its name with a line of CBD-infused beverages intended to help consumers refresh and relax. Now, the brand is adding a jolt of energy to its lineup with its latest innovation, Peach Mango Green Tea + Energy. - Cloud Water launched the new drink online this week, selling direct-to-consumer for $34.95 per 12-pack of 12 oz. cans.

- Each drink contains 30 calories and 80 mg natural caffeine sourced from green coffee beans as well as electrolytes and Vitamins B6 & B12.

- Cloud Water founder and CEO Marc Siden told us at Natural Products Expo East last week that the launch is part of a “whole queue of innovation” the brand has planned for the coming months and that moving into Q4 the company is looking to start putting pedal to metal as it preps for larger growth in 2024.

- “It’s endless what we can do,” Siden said, noting that the addition of an energy line was a longtime consumer request.

- In retail, Cloud Water has been leading with its Immunity line, recently adding accounts like Central Market and Walmart in Texas and entering New York DSD house Rainforest this year.

- Online, Siden said the brand’s flagship CBD drinks are continuing to sell and while it’s no longer a focus for retail, CBD will continue to be an important part of Cloud Water’s portfolio.

|

| | | | We are thrilled to announce a new offering for our food, beverage and beer communities. Introducing: Insider All Access - an even more comprehensive and engaging way to stay up-to-date on the latest industry happenings. Read the story. |

| | 👷🏼♂️ From the Job Board | | | | | Maintains and repairs all building systems. Testing System's and working well with others. Job Details |

|

|

| |

| | | |

|